62% of Buyers Are Wrong About Down Payment Needs

Contrary to common misconception, a down payment is often much less than many believe.

According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market:

“More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.”

When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think they’ll have to wait several years (in some markets) to come up with the necessary funds to buy their dream homes. The report continues to say,

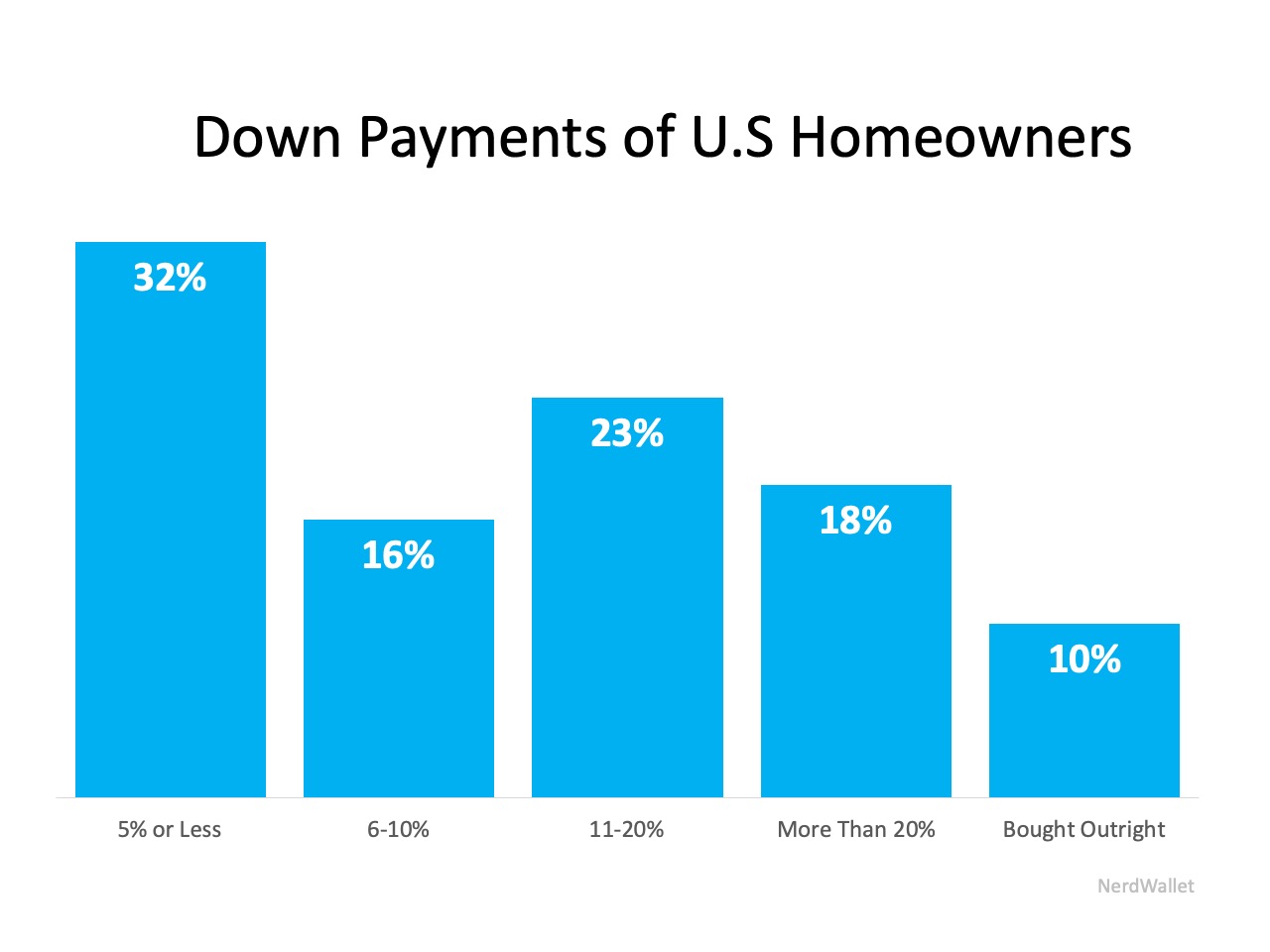

“The truth: 32% of current U.S. homeowners put 5% or less down on their home, according to census data.” (as shown below):

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

Bottom Line

Don’t let a lack of understanding keep you and your family out of the housing market. Let’s get together to discuss your options today.